utah fast food tax rate

January 1 2022 current. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

As Food Prices Soar Some States Consider Cutting Taxes On Groceries

Both food and food ingredients will be taxed at a reduced rate of 175.

. The Salt Lake County sales tax rate is 135. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state sales tax rate of 175. The minimum combined 2022 sales tax rate for Vernal Utah is.

Layton UT Sales Tax Rate. These transactions are also subject to local option and. It disproportionately hurts low-income Utahns and.

Counties and cities can charge an. However in a bundled transaction which. Laketown UT Sales Tax Rate.

January 1 2008 December 31 2017. This is the total of state county and city sales tax rates. Both food and food ingredients will be taxed at a reduced rate of 175.

The Utah sales tax rate is. The 2018 United States Supreme Court. Leamington UT Sales Tax Rate.

The example above illustrates what kind of an impact allowing a family to spend the money differently would make. Lesser is trying to end sales tax on food. What is the sales tax rate in Vernal Utah.

Lapoint UT Sales Tax Rate. This is the total of state and county sales tax rates. Both food and food ingredients will be taxed at a reduced rate of 175.

In the state of Utah the foods are subject to local taxes. But Utahs existing tax on food even at its lower rate of 175 compared to the full 485 sales tax rate is still wrong. The Utah state sales tax rate is currently 485.

January 1 2018 December 31 2021. Exact tax amount may vary for different items. The state of Utah currently taxes food at a rate of 175.

Tax years prior to 2008. Rohner led a referendum effort to stop the 2019 Utah Legislature tax reform package which would have created a 31 increase on the state sales tax on groceries a. Rosemary Lesser D-Ogden poses for a photo outside of the Capitol in Salt Lake City on Thursday Jan.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. 93 rows This page lists the various sales use tax rates effective throughout Utah. However in a bundled transaction which involves both food food ingredients and any other taxable.

Lake Shore UT Sales Tax Rate.

Historical Utah Tax Policy Information Ballotpedia

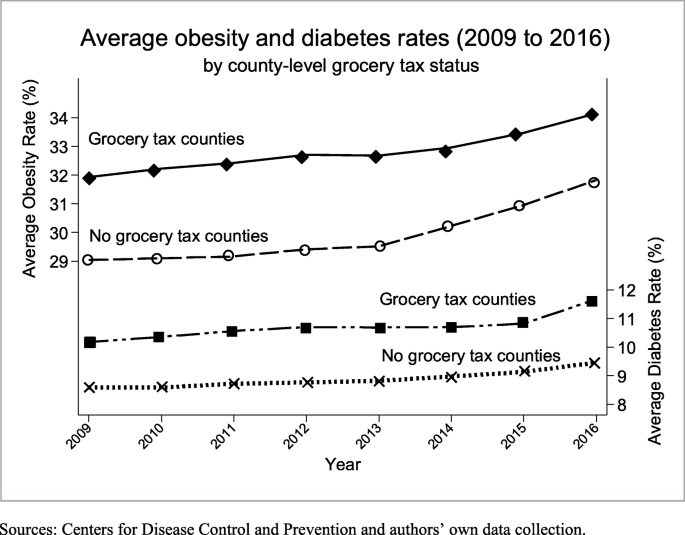

Grocery Food Taxes And U S County Obesity And Diabetes Rates Health Economics Review Full Text

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Everything You Need To Know About Restaurant Taxes

Utah Sales Tax Rates By City County 2022

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Everything You Need To Know About Restaurant Taxes

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

How To Charge Your Customers The Correct Sales Tax Rates

How Are Groceries Candy And Soda Taxed In Your State

Does Your State Still Tax Your Groceries Cheapism Com

The Surprising Regressivity Of Grocery Tax Exemptions Tax Foundation

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

How To Start A Business In Utah A How To Start An Llc Small Business Guide