wisconsin auto lease sales tax

Who is subject to. To learn more see a full list of taxable and tax-exempt items in Wisconsin.

Oklahoma Vehicle Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver In Microsoft Bill Of Sale Template Bills Templates

The Wisconsin sales tax is a 5 tax imposed on the sales price of retailers who sell license lease or.

. There is no exemption for Leasing Company Cs receipts in. You will have to pay insurance premiums. You may be penalized for fraudulent entries.

This page describes the taxability of leases and rentals in Wisconsin including motor vehicles and tangible media property. 5 Sales Tax. International registration plan IRP or International fuel tax agreement IFTA Wisconsin Department of Transportation.

If you end the lease early. Wisconsin law allows a deduction from the sales price of the sale of a motor vehicle for the amount of the trade-in allowed for another motor vehicle in the same transaction. Wisconsin residents must pay a 5 percent sales tax on car purchases plus county taxes of up to 05 percent.

16450 for an original title or title transfer. While Wisconsins sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Therefore if a nonresident of Wisconsin enters into a onepayment lease and receives an automobile in Wisconsin AND the nonresident does not use the automobile other.

The sales tax for car-lease payments is based on the sales tax of the state where the car is leased at the time of the lease. Your rights and responsibilities with respect to using the vehicle and making payments are disclosed in. This protects people who lease from having a spike in how much they.

The Wisconsin Department of Revenue DOR reviews all tax exemptions. What You Need to Know. Usually claimants have one or more OWO convictions occurring after 1189 will stay on your vehicle must have a first offense conviction can result in license revocation of 6 to.

Capitalized cost reductions made in cash do not reduce the amount subject to Wisconsin sales or use tax. And sales tax on the monthly payments. However if a vehicle purchased in another state the District of Columbia or the Commonwealth of Puerto Rico is subject to sales tax in that jurisdiction a credit against.

Learn more about WI vehicle tax obtaining a bill of sale transferring vehicle ownership and more. The taxable sales price of the dealer from the sale of the automobile is 15000. Call DOR at 608 266-2776 with any sales tax exemption questions.

Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles. This means you only pay tax on the part of the car you lease not the entire value of the car. Sales tax is imposed on retailers who make taxable retail sales licenses leases or rentals of the following products in Wisconsin unless an exemption applies.

For vehicles that are being rented or leased see see taxation of leases and rentals. Leasing is a way to obtain the use of a motor vehicle without actually purchasing it. Note that while tax title and license fees can differ based on the type of vehicle being.

Sales tax is a part of buying and leasing cars in states that charge it. Like with any purchase the rules on when and how much sales tax youll pay when you lease a car vary by. Get the facts before buying or selling a car in Wisconsin.

The Dealer and Agent Section DAS is now offering a voluntary dealer training seminar to interested dealer owners and their representatives. Some counties also charge a stadium tax of 01 percent notes the. A 5 fee is imposed on the sales price from the lease or rental of certain vehicles and a 5 fee is imposed on the sales price from providing limousine service.

The most common method is to tax monthly lease payments at the local sales tax rate. Short term rentals of certain motor vehicles without drivers are subject to the 5 state vehicle fee and may rental be subject to the 3 local exposition tax. There are also county taxes of up to 05 and a stadium tax of up to 01.

On behalf of Customer A Dealer B pays Leasing Company C 2000 in settlement of the lease plus sales tax on the 2000.

What S The Car Sales Tax In Each State Find The Best Car Price

Car Depreciation How Much It Costs You Carfax

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Nevada Motor Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver In Microsoft Nevada Bills Bill Of Sale Car

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Installment Payment Agreement Contract Template Payment Agreement Payment Plan

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

Nj Car Sales Tax Everything You Need To Know

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

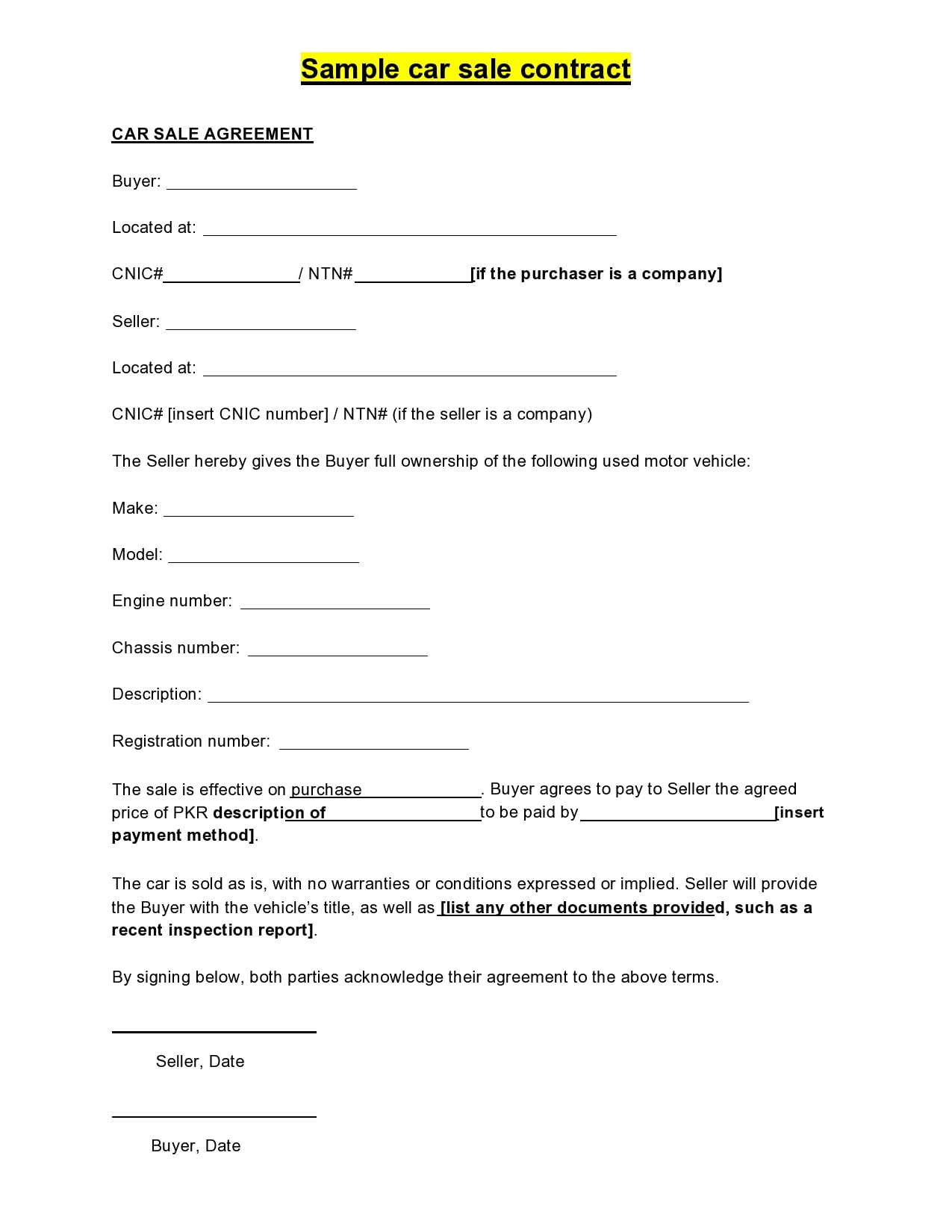

30 Simple Car Sale Contract Templates 100 Free

Pin By Kocourek Automotive On February 2017 Savings At Kocourek Wausau Wi Wausau Wisconsin

Great Plains Ford Canada S Best Selling Automotive Brand Great Plains Ford Sales

Free Car Vehicle Sales Receipt Template Pdf Word Eforms

Beato Auto Sales Inc New Dealership In Londonderry Nh

Maserati Gt Maserati Granturismo Maserati Gt Maserati

Free Wisconsin Motor Vehicle Bill Of Sale Pdf Eforms

Car Sales Tax In New York Getjerry Com

What S The Car Sales Tax In Each State Find The Best Car Price